Saving up by selling stocks

More stories from Ellen Garrett

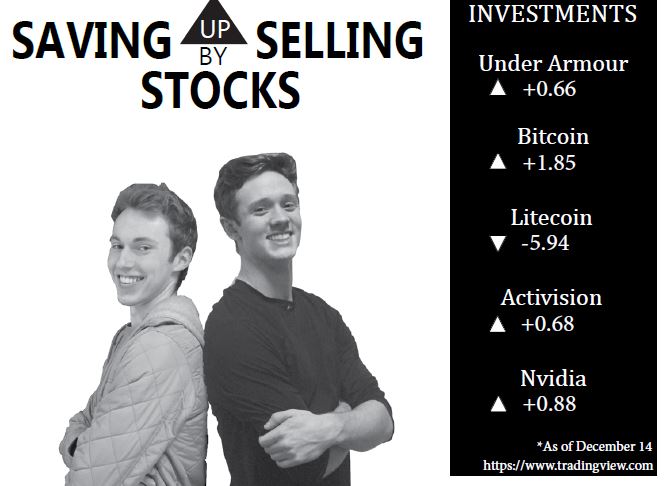

Buying and selling stock is not something that most high schoolers have much experience in. For seniors Warren Dietz and Creighton LaRose, tracking the investments they have made and the stock market is a part of an everyday routine.

The stock market follows companies’ ups and downs in profits. If a company does well and raises its profits, the stock for that company will rise as well. If it is not doing well and the profits are down, the stock goes down.

“Stock is just a piece of the business, it’s an ownership,” former financial management teacher Kathy Shockley said.

At the high school, information about investing and stock is covered shortly in Financial Management 1 and is expanded on in Financial Management 2. LaRose said investing is very versatile in nature, and can be done through apps, traders, advisors and more.

Dietz was first introduced to investing by his father, but soon began to use other methods such as apps to buy Litecoin and Bitcoin, forms of cryptocurrency. Cryptocurrency is a digital currency that uses coding techniques to secure transactions and to control the creation of additional units. Dietz learned about investing from the internet, and has been investing for less than a year.

“It’s a good way to invest your money,” said Dietz “I’ve invested in Under Armour and a little in Litecoin and Bitcoin.”

LaRose began seriously investing in October, but has been interested in investing for over a year. Like Dietz, he also purchases and trades cryptocurrency.

Shockley said investing takes significant attention in order to do it right. Adults and even teenagers who choose to invest need to concentrate and understand what exactly they’re doing.

“[Investors] need to be aggressive about investing, and they need to be very involved in the stock market. They need to learn about the rule of 72,” Shockley said.

The rule of 72 is a formula that shows how long it will take to double invested money. The formula takes the number 72 divided by compounded interest, to produce the time, in years.

In the end, Shockley believes the most important lesson in investing can also be applied to life.

“You can lose everything you invest, that’s why you have to invest wisely,” Shockley said.